mass wage tax calculator

For most homeowners Bay State property taxes are between 1 and 2 on average. For example the 2019 Boston property tax rate is 1054 per 1000 of value for residential property.

Salary Paycheck Calculator Calculate Net Income Adp

Note that you can claim a tax credit of up to 54 for paying your Massachusetts.

. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. After a few seconds you will be provided with a full. 15 Tax Calculators 15 Tax Calculators.

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. C1 Select Tax Year. The Massachusetts Income Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year.

These methods which are explained in Income Tax Withholding Tables. The tax rate is 6 of the first 7000 of taxable income an employee earns annually. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the.

The Federal or IRS Taxes Are Listed. Massachusetts Massachusetts Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent. If you make 107000 a year living in the region of Massachusetts USA you will be taxed 21819.

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax. Your average tax rate is 1560 and your. Simply enter their federal and state W-4.

The Massachusetts Tax Calculator. That means that your net pay will be 43041 per year or 3587 per month. Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the.

Massachusetts Income Tax Calculator 2021. 50 personal income tax rate for tax year 2021 For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest dividends and. This is only a high level federal tax income estimate.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Your average tax rate is. Enter your salary or wages then choose the frequency at which you are paid.

Estimate Your Federal and Massachusetts Taxes. Calculate withholding either by using the withholding tax tables or by using the percentage method. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts.

Payroll Tax Engine Symmetry Tax Engine

1040 Individual Income Tax Return Forms W 2 Wage Statement And Calculator Concept Of Income Taxes And Federal Tax Information Stock Photo Alamy

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Massachusetts Income Tax Calculator Unibank

Massachusetts Sales Tax Rate Rates Calculator Avalara

How To Calculate Massachusetts Income Tax Withholdings

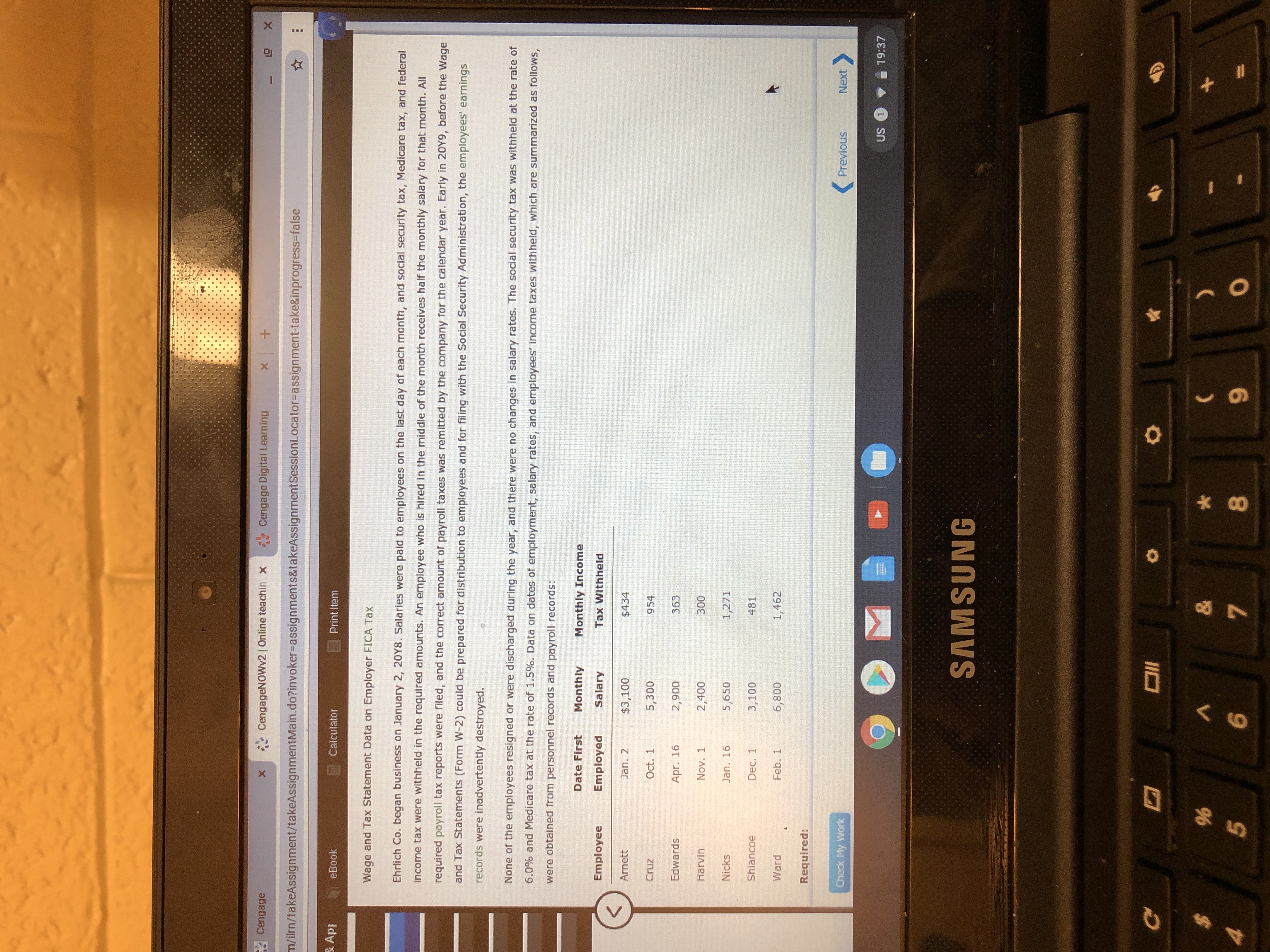

Answered Cengage Cengagenowv2 Online Teachin X Bartleby

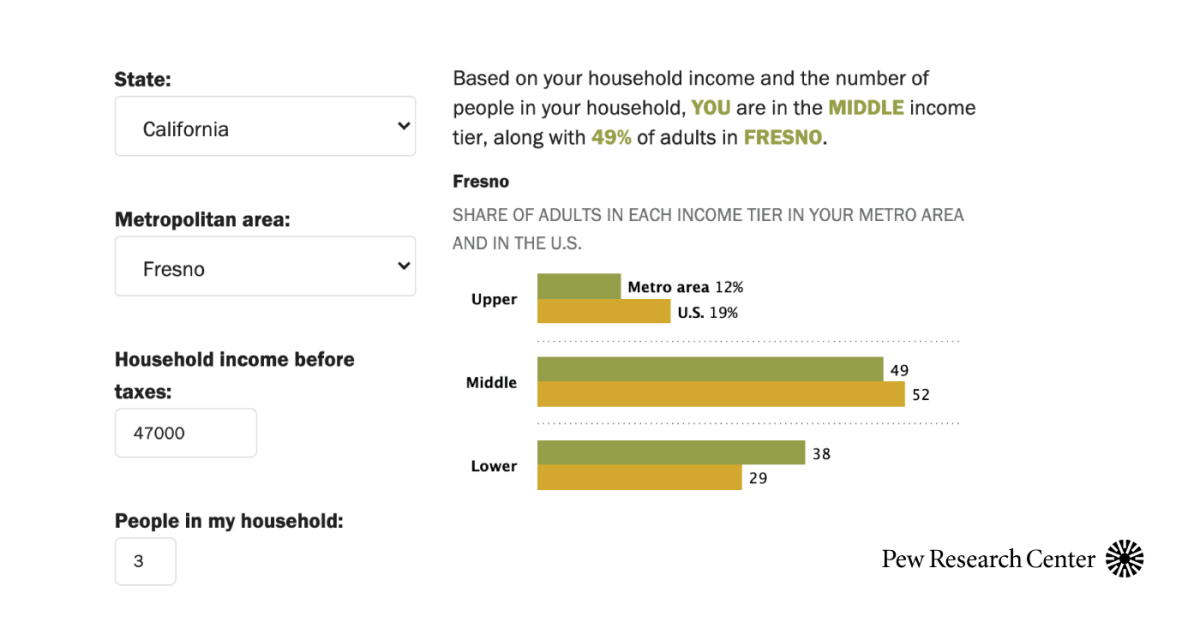

Are You In The U S Middle Class Try Our Income Calculator Pew Research Center

President Biden Signs Inflation Reduction Act Hkg Llp

Massachusetts Paycheck Calculator Smartasset

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

1099 Tax Calculator How Much Will I Owe

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Massachusetts Taxpayers To Get 13 Refund Of 2021 State Taxes In November Cbs Boston

New York Hourly Paycheck Calculator Gusto

Massachusetts Paycheck Calculator Smartasset

Free Massachusetts Payroll Calculator 2022 Ma Tax Rates Onpay